ISIN APPLICATIONS

SOFTWARE & SOLUTIONS

IMPROVED TIME TO ISSUANCE

The automation of application procedures results in a significant reduction in time to issuance both in terms of client response, regulatory requirements and service level agreements.

INDIVIDUAL AND BULK APPLICATIONS PROCESSING

pTools ISIN applications processing enables individual and bulk upload and management for requestors in a manner that enhances client relationships while maintaining data quality.

DATA STANDARDS QUALITY

Standardisation of data inputs and automation of data generation against ISO standards for CFI, FISN, Currency, Country Codes and more enhances data quality for the organisation across process, reporting and regulatory compliance requirements.

STRONG AML ASSESSMENT

Understanding AML risk within applications processes is critical. Automated data validation, look-ups and cross checking drives improvement in AML risk mitigation. Risk of fraud, regulatory impact and reputational damage is significantly reduced.

IMPROVED CLIENT DATA QUALITY

pTools Blockchain and Notarization technologies encourage clients to provide more accurate and timely information for applications processing and ISIN issuance. This improvement in data quality is immediate and striking across all aspects of the process.

REDUCTION IN STAFFING

Process automation reduces the need for manual intervention and allows staff to concentrate on critical tasks as well as enabling redeployment to new tasks and areas of need within the organisation.

BETTER ESCALATION PROCEDURES

Where risk or error is identified within an applications process, pTools ISIN solution allows managed escalation to senior personnel responsible for key decisions on issuance or rejection as needed.

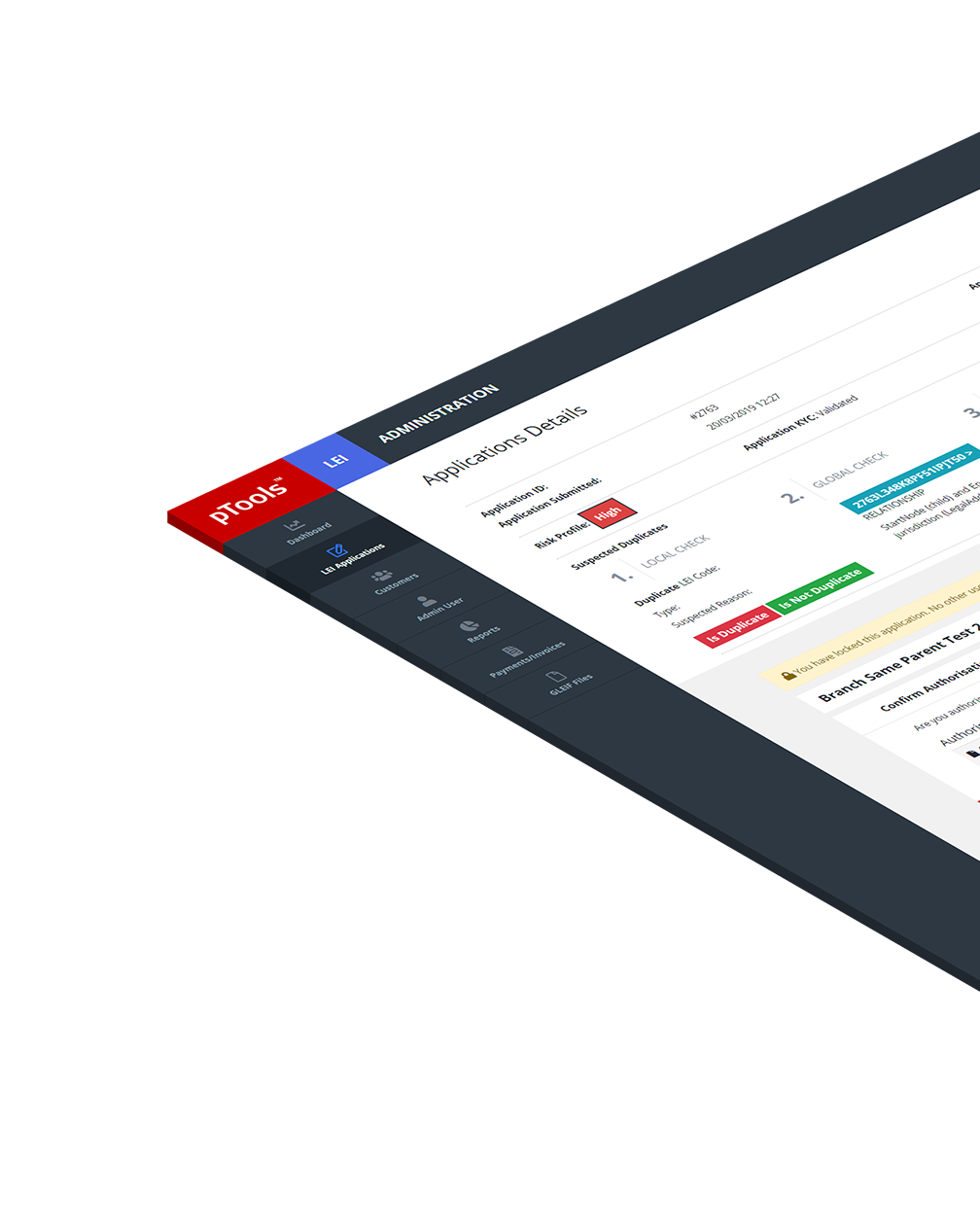

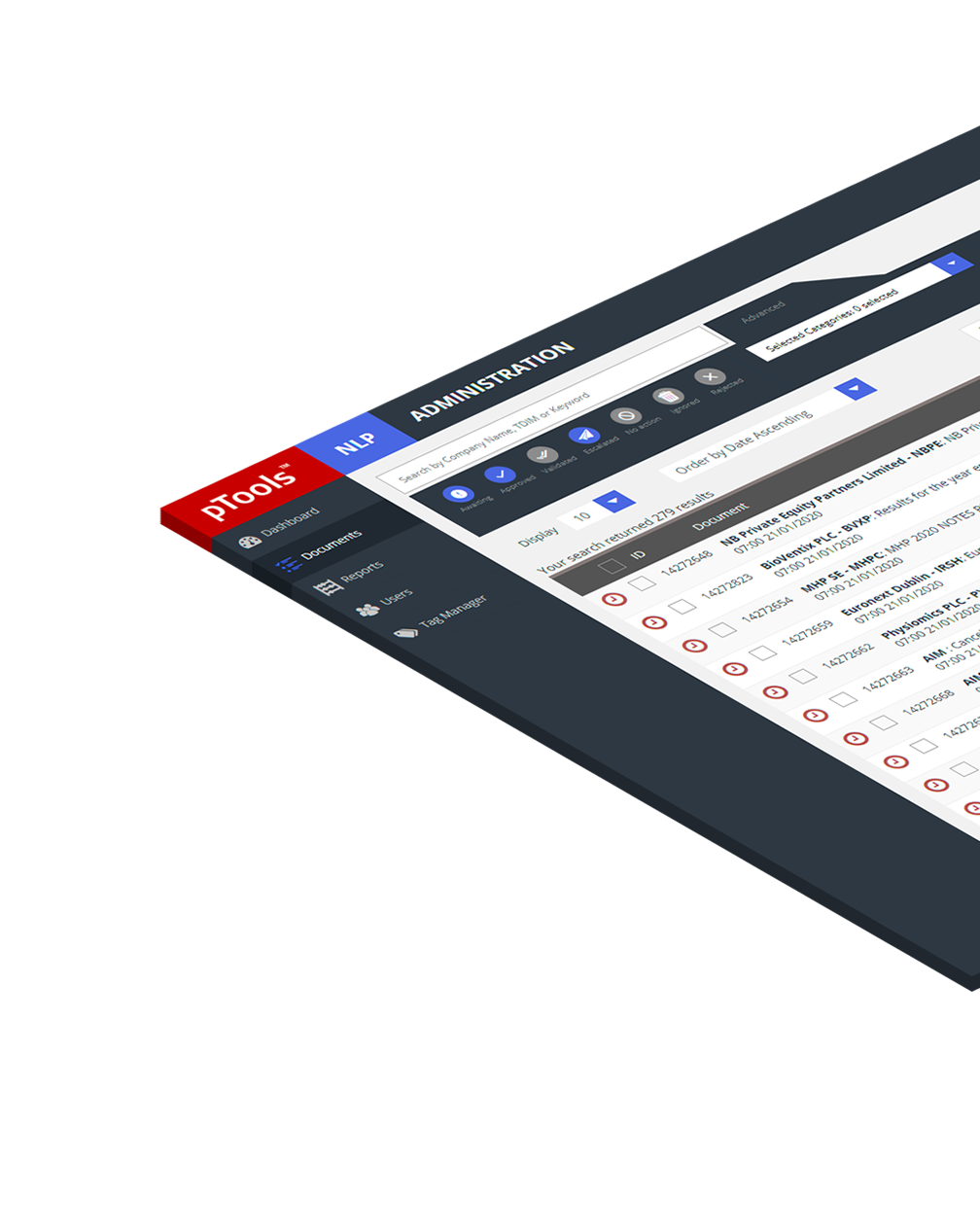

OUTSTANDING USER EXPERIENCE

Both clients and staff benefit from expert user interface design that drives performance and improved experience across the process. This is for both front end client use and back end administration extending to management dashboards and reports.

MULTIPLE ASSET-TYPES MANAGEMENT

Solutions enable handling of multiple asset-types within a single applications environment including Equity, Debt, Funds with related automation of reporting indicators and messaging.

POWERFUL RISK MITIGATION

Reduction in risk across regulation, AML, fraud, and reputation requirements is a key benefit of pTools ISIN application processing and automation with all the related benefits of efficiency and automation, compliance and risk mitigation.

KEY BENEFITS:

- Stressful deadlines are turned into positive response times

- Experienced staff are empowered to handle escalations and issues

- Client data quality is transformed by persistent enforcement of data standards

- Alignment with ISO data standards rationalizes risk and compliance

- Built-in anti-money laundering features significantly mitigate risk

- Bulk applications processing for issuers increases efficiency

- Escalation to experienced staff for critical decisions

- Expert User Experience enhances performance and relationships

- Multiple Security asset-types are all handled in-process

- Risk mitigation is at the heart of pTools Applications Software and Solutions

See more of our solutions

ISIN APPLICATIONS

SOFTWARE & SOLUTIONS

To find out more about pTools please email connect@pTools.com